What do clients need to know about the Form 1095-A, Form 8962, and their taxes? FFM StatesĮxplain how completing Form 8962 may affect how much they owe. We’ve included FFM and state-based Marketplace contact information below, and you can find SBM information here. If anything on the 1095-A is incorrect, either you or your client will need to call the appropriate Marketplace to correct any mistakes. Most of this information should be visible in your Clients list, and you can use this tool to confirm their Second Lowest Cost Silver Plan (SLCSP). Simply click ‘Search Marketplace’ in the top right of your HealthSherpa account and fill out the following form with their information from last year’s application.Ĭheck that the information listed on your client’s 1095-A is correct. Note: You can also download Form 1095-A even if you did not help the client enroll in their prior year’s coverage. You can do this by clicking into a specific Client and scrolling down to their ‘Application History.’ How can agents service clients with Form 1095-A?ĭownload Form 1095-A to share with your clients. Your clients will soon begin to receive Form 1095-A’s through the mail, but you also can download them today on behalf of your clients through your HealthSherpa agent account.

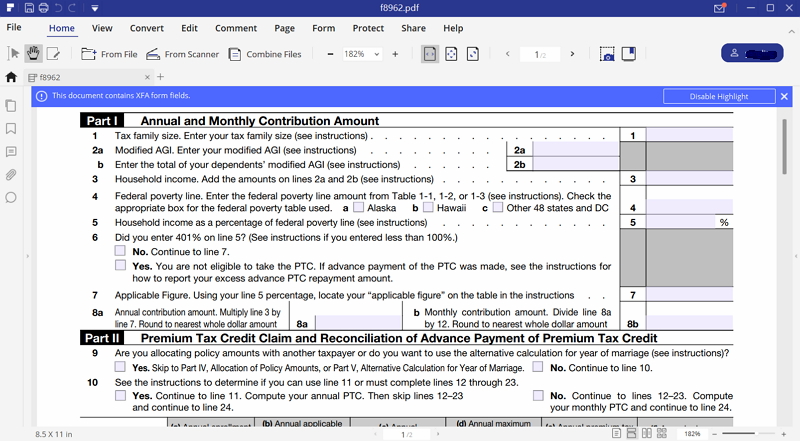

You can find an example Form 1095-A here and an example Form 8962 here from irs.gov.

Here’s some information on this health insurance tax form and what you can do for your clients this tax season through your HealthSherpa account.īoth the federally-funded Marketplace and state-based Marketplaces (FFM and SBM, respectively) use Form 1095-A to report information on enrollments in a qualified health plan (QHP). Form 1095-A, or the Health Insurance Marketplace Statement, is one of your first opportunities to provide year-round value to your clients.

0 kommentar(er)

0 kommentar(er)